Introducing revenue-based financing for e-shops!

What is revenue-based financing?

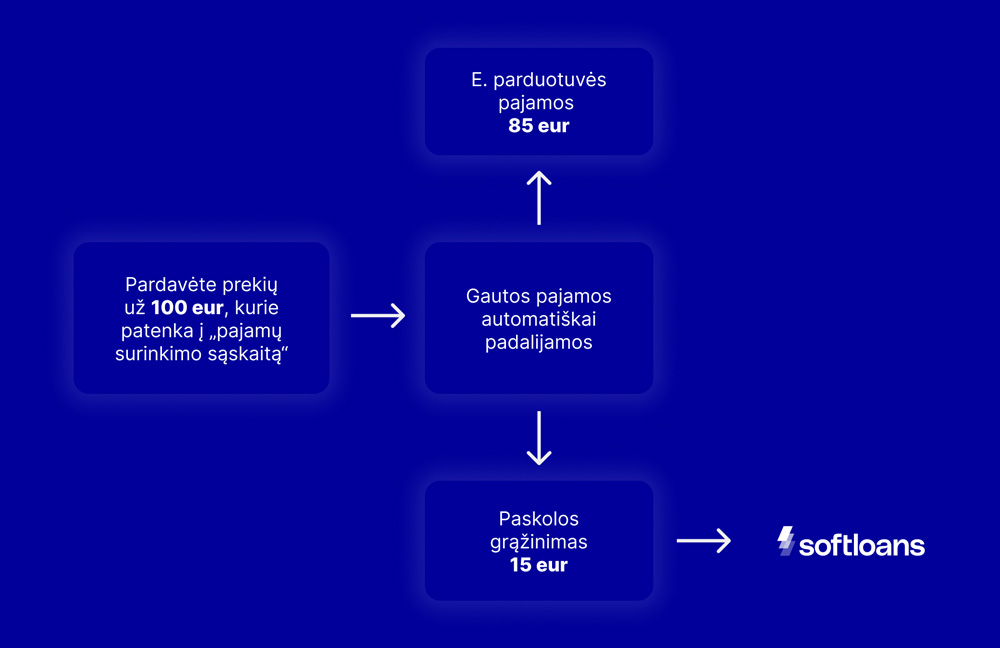

Revenue-based financing (RBF) allows businesses to secure funding and repay it based on their sales results – an agreed percentage of incoming revenue is used for repayments. This flexible repayment model adjusts to your business performance.

-

Higher sales = quicker repayment

-

Lower sales = slower repayment

Benefits of Softloans revenue-based financing for e-shops

Revenue-based financing, and in this case Softloans, is beneficial for e-shops for multiple reasons.

Quick funding. Fully digital processes allow for fast assessment, so you receive your financing offer and the funds in record time.

No collateral is required. Softloans will assess your business by using your business revenue information and suggest an appropriate deal based on the data instead of relying on collateral.

Flexible repayments. The repayment schedule is based on your business sales results to ensure adaptability. In other words, there is no fixed amount you’d have to pay back every month.

No interest rates for the loan. There will only be a one-time loan fee.

Business insights. The Softloans solution provides live analytics of your marketing, sales, and finance data to help you manage and grow your e-shop effectively.

Who can use the Softloans solution?

To qualify for Softloans’ revenue-based financing, your e-shop must meet the following criteria:

-

Minimum monthly revenue: at least 3,000 EUR.

Operating period: active for more than 12 months.

-

Platform compatibility: hosted on reliable third-party platforms such as Shopify, WooCommerce, Magento, PrestaShop, OpenCart, Wix, or Amazon.

Pricing and repayment conditions

You will receive a loan offer that is based on your business data so the one-time fee and the share of the revenue used for repayments varies to adapt to each merchant.

Here is an example of a typical offer:

Financing amount – 9,000 EUR.

Share of incoming revenue used for repayments – 15%.

One-time fee – 10% or 900 EUR.

Financing term – up to 12 months.

The maximum loan amount is 100,000 EUR, with a loan term ranging from 3 to 12 months.

How to get started?

The process to receive financing for your e-shop is quick, digital, and will go directly through Softloans. Softloans will also be assessing your case and contacting you to suggest a solution.

Allow us to walk you through the process step-by-step.

Step 1. Create an account on the Softloans platform and provide information about your company.

Step 2. Select your desired financing amount and the repayment term. Softloans will prepare an offer based on the actual data of your business, but it’s good to understand your needs and expectations to find the best solution.

Step 3. Confirm that you will use your Paysera account to repay the loan.

Where to get help?

If you have further questions about revenue-based financing in general or specifically about Softloans, please contact Softloans for support.

Email: [email protected]

Phone: +37062011318