Is it safe to pay online via your bank?

How does online payment via a bank work?

- The customer adds a product to the cart and proceeds to the checkout.

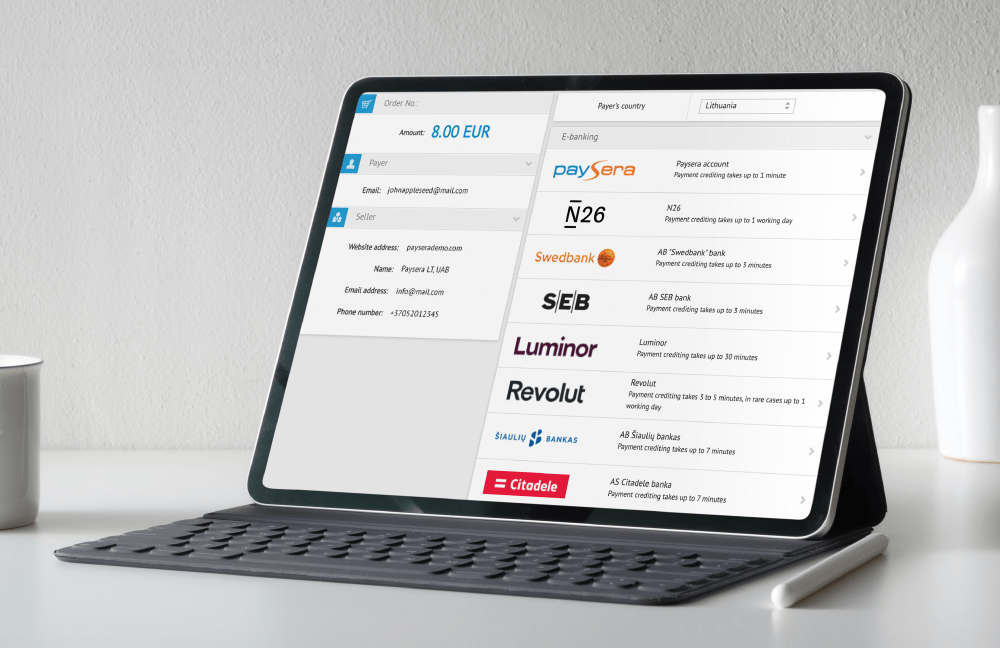

- Then the customer chooses a payment method (card, online banking, SMS, cash, etc.)

- If the customer chooses to pay via their bank, they are asked to log in to their bank account.

- After the customer enters their login details they are asked to confirm the payment.

- When the payment is confirmed, the customer is redirected back to the shop.

Is it secure to enter your bank login details in an e-shop?

The payment process in e-shops that use payment gateways like Paysera Checkout is seamless and the buyer does not actually provide any bank login details to the e-shop itself.

Customers are redirected to their bank and that’s where they enter all their personal information which is not stored in the e-shops nor in the payment processing service provider’s database.

How to know if the e-shop uses a secure payment processing service provider?

In order to accept payments online, e-shops use something called a payment gateway. It is a link between the seller's website and the buyer and it enables the latter to pay and for the payment to reach the shop owner in exchange for goods and services.

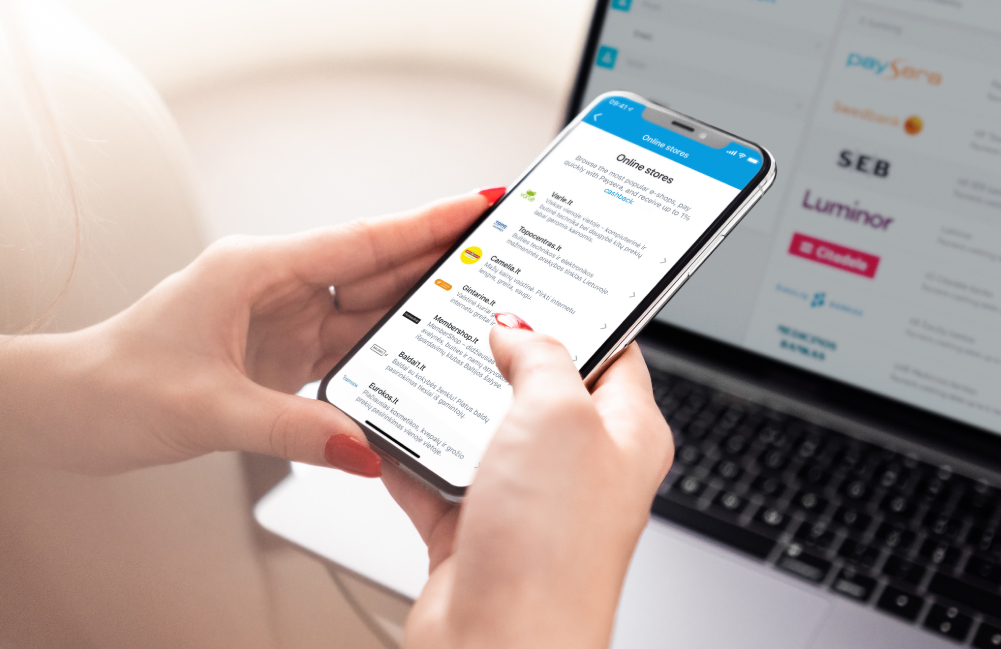

The payment gateway Paysera Checkout, for example, is used by thousands of online stores and is trusted by millions of clients for more than 10 years.

Paysera is an international fintech licensed and supervised by the Bank of Lithuania. The highest security standards are also maintained by acquiring various security certificates, such as the PCI DSS (Payment Card Industry Data Security Standard), which is crucial in order to securely process card payments.

If you have more security-related questions – Paysera has 24/7 client support in English and can be reached both by phone +44 20 80996963 or email [email protected].

So when looking into the security of the payment processing partner of your e-shop you should look at these aspects:

E-commerce as well as digital banking is booming in Europe and beyond. At the same time, questions of data security and financial fraud are more important than ever before. Therefore, when shopping online or choosing a payment processing partner for your e-shop you should make sure that such a partner can not only be trusted, but also be versatile, and offer clients safe, varied, and convenient ways to complete payments.