Opening a cumulative account completely online

Save valuable time and effort with the possibilities offered by Paysera!

Support and assistance every step of the way

Competitive low fees. See more here

An online process with client support by email or phone

Detailed information for each stage of the procedure

Full support from our team for the preparation of the required documents

Who is it suitable for?

- Individuals who want to establish a private company in Bulgaria.

- They can be Bulgarian or foreign citizens.

What is the cumulative account for?

Registration of a new companyA cumulative account is required to establish a private company in Bulgaria. The account is used for the deployment of authorised capital prior to the company being registered in the Commercial Register.

⚠️

The cumulative account IS NOT a payment account and can’t be used for payments different from the authorised capital – incoming and outgoing.

Steps for opening a cumulative account

Frequently asked questions

The cumulative account is only used for depositing the authorised capital when establishing a private company in Bulgaria. It can’t be used for payments different from the authorised capital – incoming and outgoing.

The payment account is suitable for your daily banking operations. It can be managed by online or mobile banking in real-time. The Visa card can be added to the account and used for cashless payments.

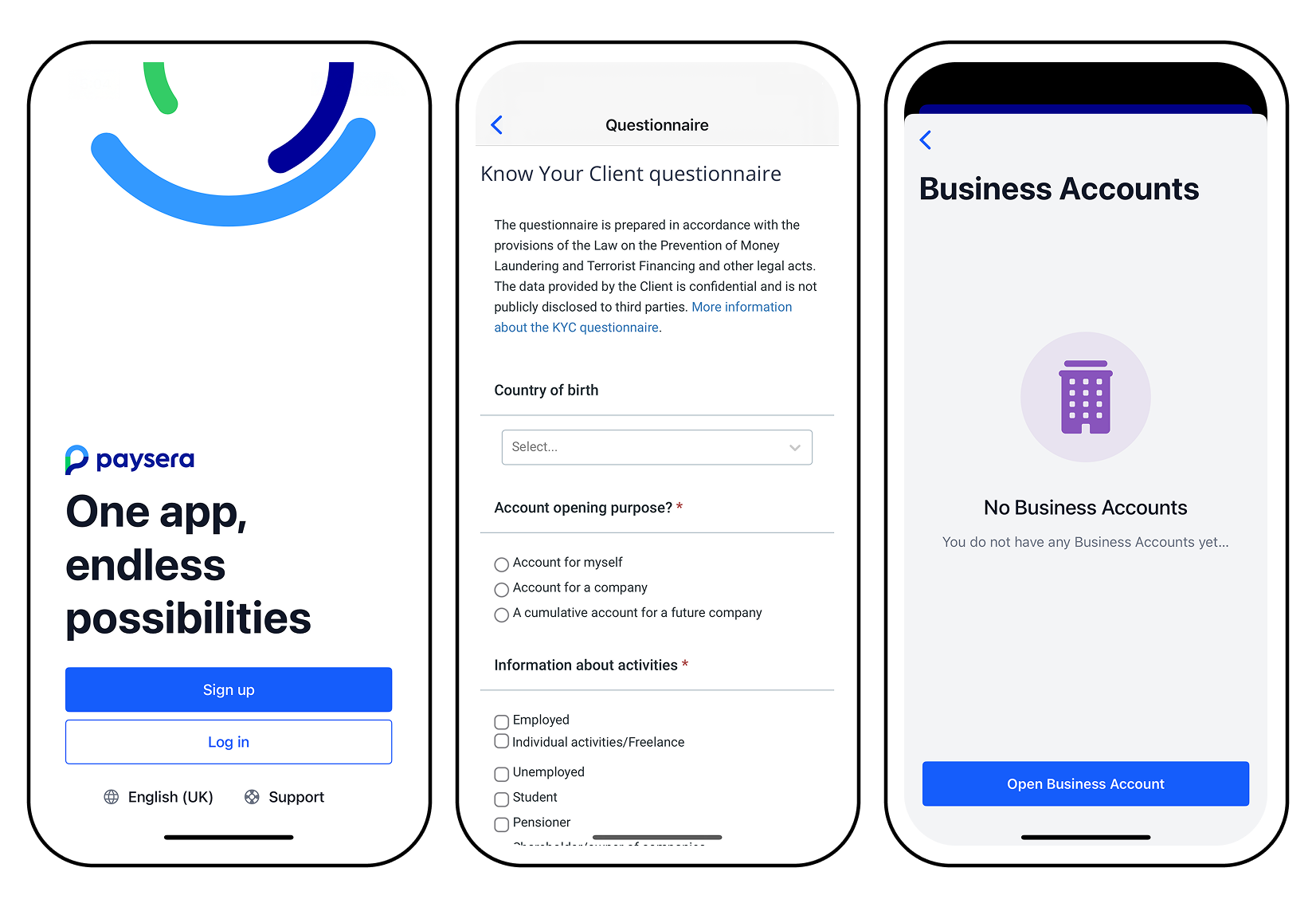

The cumulative account can be opened by the future manager or company representative. They have to register in Paysera via the mobile app, perform complete identification as an individual, and fill out a Know Your Customer (KYC) questionnaire. After that, they request to open a cumulative account by email.

Depending on the structure and activity of the company, it is possible to be requested additional documents, other than the ones mentioned below, or to be sent clarifying questions.

Documents required for opening a cumulative account:

- Cumulative account agreement;

- Articles of association;

- Minutes of resolution of the General Assembly of the Shareholders/Sole Owner of the Capital on the establishment of the company.

The client should provide information about:

- The shareholders/sole owner of the company;

- The amount of the startup capital and, in the case of a limited liability company, how it is distributed among the partners;

- Who will represent the future company;

- A detailed description of the specific activity of the company;

- Potential business partners, suppliers, and customers;

- Explanation of the aims (purposes) of future payments on the account;

- Website and/or link to e-commerce platforms, if used.

Following the registration of the company with the Registry Agency, the client should open a business account, fill out the KYC questionnaire and submit a request to Client Support to close the cumulative account and transfer the capital to the newly opened business account.

The capital should be deposited by bank transfer from a Bulgarian bank in leva (BGN).